The Next Two Normals

The challenge: suddenly knowing the “when” but not the “what”

The duration of the COVID crisis is suddenly fairly clear. As a leader in commercial office real estate, once you have clarity, you and your stakeholders should expect a set of strategies and plans of action.

After three weeks in April turned to three months and then turned to “who knows,” we can now anticipate that between March and June of next year, societal immunity will emerge largely from waves of effective vaccinations from multiple suppliers.

We now know that in 2021 we will face two very different environments in commercial real estate.

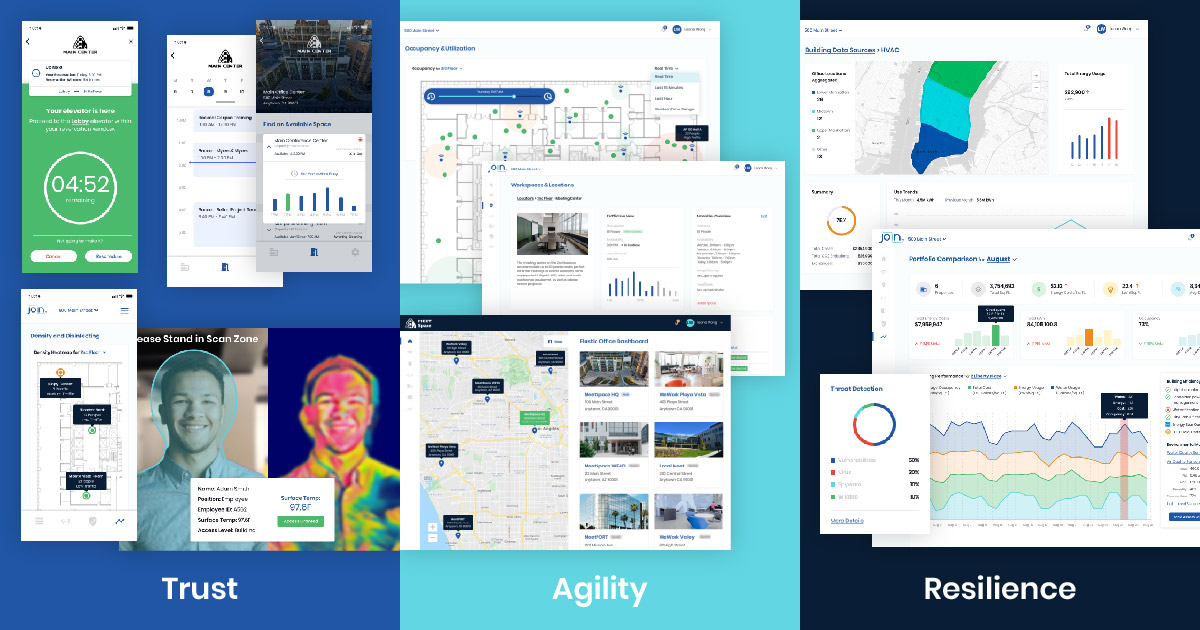

One starts with pervasive community transmission as severe as ever, but that gets steadily better as groups receive vaccinations and start to break chains of transmission. This will last for months, and therefore will be a next normal. During this period, as we wrote previously in this newsletter, the priority is on elevating trust with digital amenities that provide building users and operators with more information about their workplace.

Then, we will experience a second period for the rest of the year, when the danger is largely past and we learn to operate in an environment altered by the crisis in lasting ways.

The “when,” or the time to start planning, is known. It is now.

The challenge is how to discover the “what,” that is the characteristics of these periods that are relevant to office workplaces.

Key questions

The critical yet still unanswered questions we wish we knew right now include:

- Will workers start to return to offices during the first period or wait until we are clearly into the second? Will the norm be fewer days per week? How many won’t return at all?

- Will enterprises need less total space because home offices have become part of the office footage inventory, or will the current footprint be reconfigured for more space per person?

- Will enterprises require new space design, perhaps in the forms of distributed campus spokes to accommodate short commutes and workers who have moved away from central districts? Will this create demand for co-working or private spaces?

- Will workers expect more private layouts for both individual workplaces and more open areas for more group “onsites”?

- Which types of vertical businesses will represent office employment growth (in the markets you operate in?)

- How much demand can owners restore with price and allowances?

- Which buildings need to be repositioned or even sold off to a different operator?

Leading companies will use the first period to answer these questions that will be very useful for navigating in the second period.

Using Agility to iteratively discover the future

How do you discover what will work when things are changing under your feet?

Rapid iteration is the answer we discovered in the world of software development, where so-called requirements shift and evolve as both the business conditions and the users’ reaction to the applications evolve constantly and interdependently.

In this case, the users are the workers in commercial offices. They may or may not be able to say what they want now, but what they ultimately prefer will evolve based on what we present to them.

The business conditions that will reveal themselves in this case are the disruption to both demand and supply. The starting condition is pretty clear: demand is lower than it was due to companies failing and shrinking, and supply is higher due to home office inventory.

Long-term leases are supposed to smooth over disruptions like this. However, we have already seen that lease holders with declining demand are putting their space into the supply inventory anyway via sublease offers. In some markets, such as San Francisco, this is introducing significant competitive headwinds.

The goal then is to put experiences that will stimulate their demand for as much space as possible in front of workers and tenants, gauge reactions and respond with new and improved experiences.

This is largely only possible with digital amenities.

Join is partnering with leading owners to create a set of digital amenities that empower workers to preview and navigate their workplaces to elevate trust especially for shared resources and spaces, and to provide insights to site managers on how to allocate space to new usage patterns.

How much is a building worth?

The alternative way to stimulate demand is by lowering rental prices and increasing allowances.

Owners have to evaluate which properties can meet their ROI goals in the face of disrupted demand and supply, which ones they need to reposition, and which ones to sell to an [owner] operator who sees more value potential.

Our company is working with owners to quantify what digital marketing and solutions can do to increase lease-up velocity, reduce operating costs, replace allowances with amenities, and create new business models within their buildings.

How to reposition buildings

For years, property owners have been repositioning both office parks and industrial lofts as tech-forward space for the technology industry, especially software developers.

One thing the tech industry discovered during COVID is that stand-up Scrum meetings - the core of why developers have to be in the office - now work with remote tools, so long as the team is roughly in the same time zone. The rest of their work is already clearly digital and cloud based.

We already see this enhanced ability to work remotely creating softness of demand in some tech hot spots as workers move to more affordable areas. This is famously happening in San Francisco right now.

But many of these areas also have strong universities, medical schools, and research centers. Technology parks are already repositioning as Life Sciences office parks roughly around available and potential laboratory facilities. We continue to work with leading owners to craft the digital and cloud access capabilities and security postures tuned to growth verticals like Life Sciences.

Next normal: real-time application and edge compute

The pandemic put the economy on digital fast forward. A powerful strategy for repositioning buildings is to make them ready for the next wave of companies and their use cases.

One element of the economy that was already increasingly its pace was a new class of applications that combine the collection of sensor and other real-time data and process it with continuously updating machine learning algorithms. The sensors in your car, your phone, your packages, etc., enable applications that map digital information into real-world, real-time operations.

Think about what goes into making a car self driving, or operating the Uber/Lyft networks, or scheduling your package deliveries.

These types of applications are now pervading every vertical: fin-tech, marketing-tech, augmented reality gaming, cybersecurity, health and wellness applications and more. And the tool sets to make these capabilities available to mere mortals operating businesses increases constantly. All of the public clouds now have rich and easier-to-use-than-ever resources for these kinds of closed loop, AI/ML powered analyses.

We expect these will become even more pervasive in the next normal. 5G will generate more data and applications. More companies will form to invent new analyses and applications.

All of these rely on low latency to move data from sensors to servers and back to displays, and ample compute capacity to operate (i.e. do the calculus on the AI/ML models’ vast quantity of features and tuning parameters).

Cloud services and cloud-based applications are getting augmented with edge data networks to enable this wave of applications.

The company is partnering with leading technology suppliers to bring these capabilities into the same edge data centers where we host our connect and secure services today. These are physically close and optically connected to the building they serve and sit on ultra-high-performance direct connections to cloud services.

A plan for period 1 to set up for success in period 2

Every owner and enterprise is coming into these next two periods with a different set of starting conditions. Luckily, brainstorming, planning, and collaboration are activities leaders can engage their team and partners in even during the darkest month or so ahead.

We are eager to engage during these next months to create a plan that you can iterate on leading up to the end of the danger and the start of successfully navigating the changes required to succeed in an even more digitized world in the next new, post COVID normal.

This Week’s Sponsor

Join delivers networking as-a-service to office owners and tenants to enable Smart Buildings and Smart Workplaces. Join’s Converged Network provides outstanding security and ultrafast connectivity to the internet with the ease-of-use of a modern cloud service. Join accelerates leasing by powering flexible space that creates great tenant experiences, transforms IT operations efficiency, and enables adoption of IoT and workplace technologies.

Read Next

5/15/2025

5/15/2025

Tech, Talent and Transformation: 2025 Digie Finalists Announced For 27 years, Realcomm has presented the Digie Awards to acknowledge companies, real estate projects, technologies, and individuals that have advanced the commercial real estate industry through the strategic use of technology, automation, and innovation.

5/15/2025

5/15/2025

Empowering Space Management with Data-Driven Visualization For effective CRE space management, it’s critical to centralize lease data, maximize rental square footage (RSF), improve energy efficiency and reconfigure spaces to meet changing needs.

5/8/2025

5/8/2025

The AI-Powered Workplace Evolution: Redefining the Business Landscape In today's rapidly evolving business environment, the fusion of Artificial Intelligence (AI) and Workplace Management is revolutionizing the way organizations approach workspace optimization and operational efficiency.

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

%20(1)%20(1)%20(1).png)