The Path to Painless Budgeting & Forecasting

Budgeting and forecasting: words to inspire dread among many in commercial property and asset management. Months of grinding work with unwieldy spreadsheets. Leasing agents, property accountants, property managers and budget directors doing their own thing rather than working as a team. Ask survivors for a printable definition of the process and you’ll probably get “necessary evil.”

Is there a better way? That question should be top of mind for everyone kicking off budgeting season right now, but I’d like to shed light on how technology is driving the evolution of the budgeting and forecasting process.

Complexity and consequences

Budgeting is very complicated for commercial property management companies because it encompasses input from multiple sources including leasing, deals in progress, CAPEX projects and loan information. Accounting rules and standards and investor demands for greater transparency require a high degree of data collection and reconciliation. The process carries multiple implications for a company’s operations, including revenue and expense projections, reporting to owners and investors, cash flow and rent growth rate predictions, sales due diligence and performance benchmarking. Budgeting represents the organization’s plan, while the forecast shows progress against that plan.

Until the recent past, complicated budgeting and forecasting requirements exceeded the means available for dealing with them. Spreadsheets, generally the tool of choice, didn’t always have the most current information and could be difficult to manage. They could be “wonderful and awful at the same time,” as Nick Moore of Lionpoint Group said in a recent Realcomm webinar on the topic. Manual data entry multiplied opportunities for errors. Forecasts had to be recalculated manually when market information changed. Lack of proper insight could result in missed rent growth targets; for big companies, being off by just 1% can mean tens of millions of dollars of lost revenue. The obligation to provide annual investor guidance with quarterly revisions added pressure. Compounding the problem, employees with extensive tenant knowledge, such as assistant property managers or leasing executives, often couldn’t access the budgeting system at all.

Relief appeared about a decade ago, when technology enabled automation of many elements of the process and incorporated budgeting and forecasting into a company’s core property management and accounting platform. This eliminated the errors associated with redundant or manual data entry and risky spreadsheets. But there was still much more to be done.

The rolling forecast approach

To that effort, Yardi worked with a group of clients in search of ways to reduce the time and effort involved in budgeting and forecasting. The solution that emerged encompassed a continuously improving forecasting model that allows iterative tweaks on a daily or weekly basis, rather than monthly, quarterly or annually.

The first step in the project involved housing live property data, construction budgets, CAPEX, loan information, lease/deal information, debt information and more in one database that’s accessible in real time and effortlessly flows into the budget.

Next came bridging the disconnect between asset managers, property managers, leasing executives and finance staff. Historically these team members communicated manually, using spreadsheets, emails and weekly phone calls. When leasing assumption updates were received from the field, the finance team would manually re-enter this information in the budgeting tool, which was slow and error prone.

The new process involved developing technology that enables intuitive portals where leasing managers and asset managers enter real-time data such as MLA updates, speculative leases and CAPEX. Property managers can access the same portal to update operating expense information. This is how Yardi® Forecast Manager, part of the Yardi Elevate suite of solutions for asset management, evolved into a user interface that pushes the workflow to the field, removes manual processes and enables continuous improvement.

The system lets leasing agents and asset managers use a dashboard to see areas of risk they need to address and MLAs they need to add or update. They can add the deal flow, construction projects and more, then create a spec lease and have it flow to the budget. And they can do it all immediately, without waiting until the end of the quarter or month or week, trading phone messages, or constructing masses of spreadsheets.

The clients in this project who adopted rolling forecasts reported better budget accuracy, improved collaboration, better investment community guidance and more accurate monitoring of their business. One of them, an industrial REIT, reduced the effort involved in forecasting by 30% while greatly improving accuracy. We also documented 40% reductions in time they needed for monthly revenue forecasting and 50% reductions in budget processing time. There’s no sacrifice of accuracy for frequency. In short, rolling forecasts make the process all “wonderful” with no “awful.”

Budgeting in an organized, strategic fashion streamlines a property management company’s entire business and generates data that strengthens decision-making. Technology continues to evolve, enabling even better analysis and long-term forecasting that helps property management companies work more efficiently with less risk. We anticipate the next steps will include incorporating predictive analytics that can show, for example, the portfolio-wide impact on NOI of changing MLAs.

New technology that creates a single source of the truth and permits continuous improvement is making budgeting and forecasting easier and more accurate. While the exercise is still necessary, it’s a lot less daunting for everybody involved.

Learn more about Yardi’s budgeting and forecasting solutions in a 30 minute webinar.

This Week’s Sponsor

Yardi® develops and supports industry-leading investment and property management software for all types and sizes of real estate companies. Established in 1984, Yardi is based in Santa Barbara, Calif., and serves clients worldwide. For more information on how Yardi is Energized for Tomorrow, visit yardi.com.

Read Next

3/27/2025

3/27/2025

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP).

3/27/2025

3/27/2025

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs.

3/13/2025

3/13/2025

How to Achieve Eco-Friendly Facility Management Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs.

1/23/2025

1/23/2025

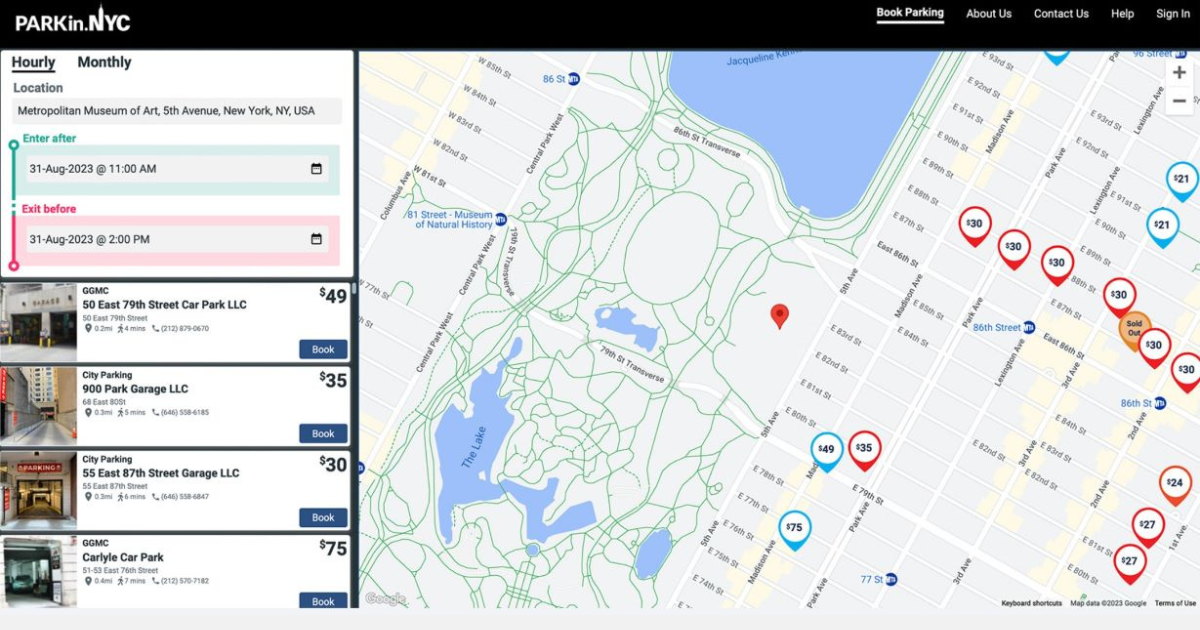

When It Comes To Managing Properties’ Parking, Technology Is Key It’s easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because it’s mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they haven’t figured out how to maximize its value.

.gif)

%20468x60%20Static.jpg)