Partner Content

The Convergence of Edge Computing, Cloud, and AI in Building Automation and Smart Buildings

In the built environment, we have seen the convergence of Operational Technology (OT) and Information Technology (IT), later expanding to include Workplace Technologies (WP)....

March 27, 2025 | 4 min read

Feature

DC Power: A Holistic Approach to Energy Savings in Commercial Buildings

In today's energy-conscious world, businesses constantly seek ways to reduce their carbon footprint and operational costs....

March 27, 2025 | 2 min read

Partner Content

How to Achieve Eco-Friendly Facility Management

Commercial real estate operators and facility managers are focusing on sustainable practices to minimize environmental impact, create healthier workplaces, improve productivity and lower operational costs....

March 13, 2025 | 4 min read

Feature

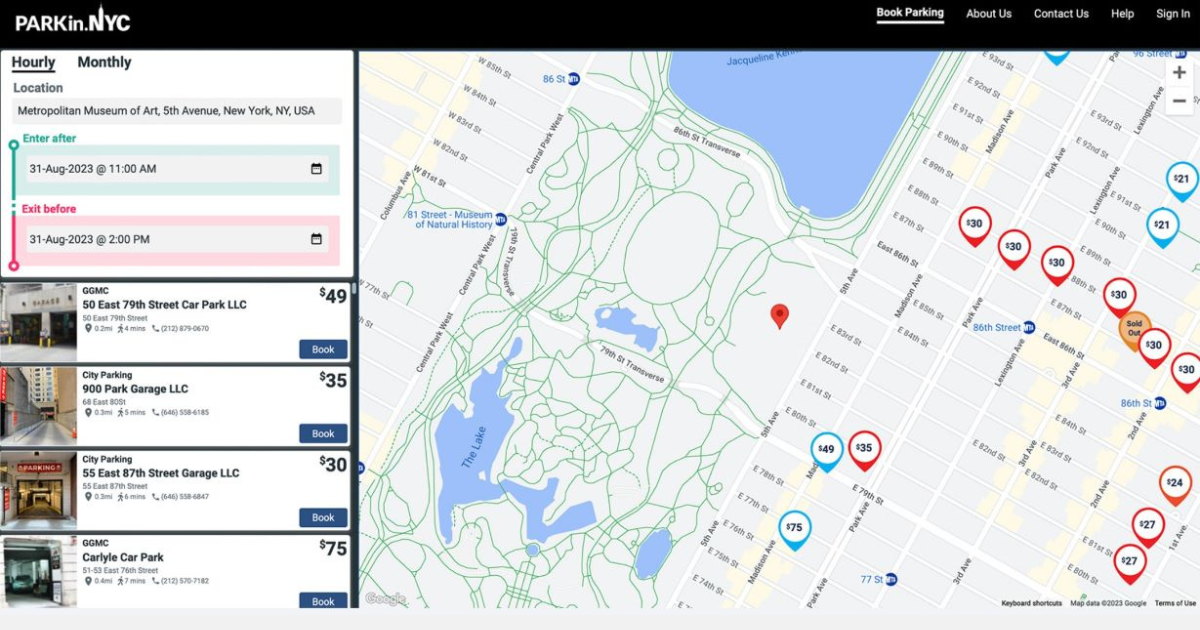

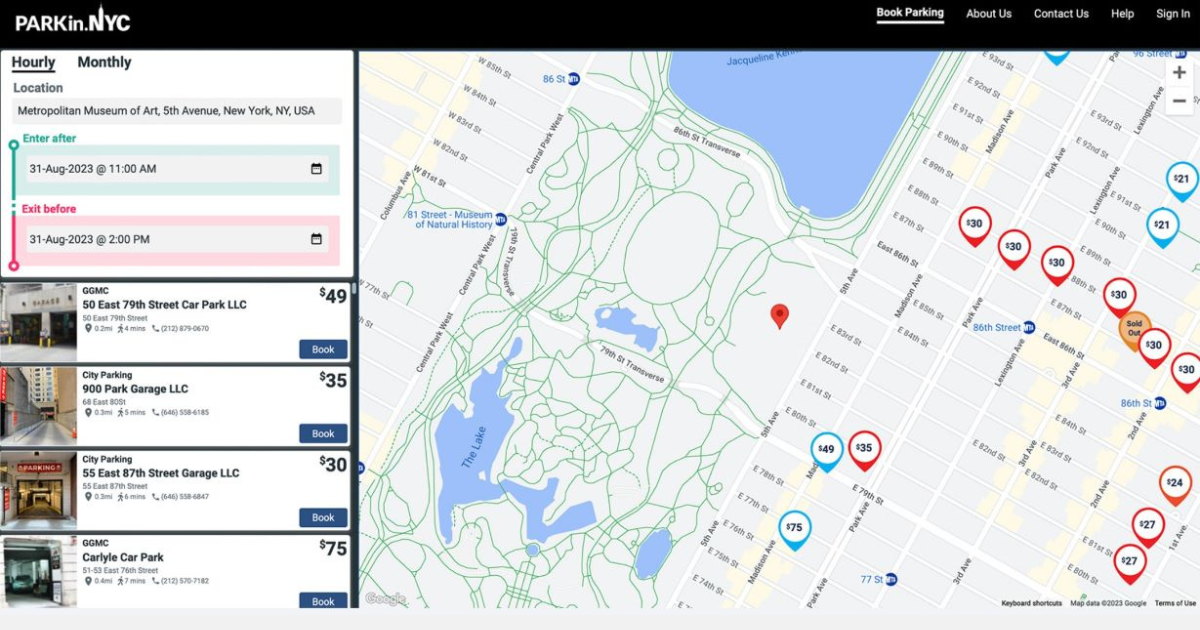

When It Comes To Managing Propertiesí Parking, Technology Is Key

Itís easy for developers and real estate owners to think of parking as a necessary evil. They know they have to provide it (often, because itís mandated by code), they understand that prospective tenants and buyers expect to be provided parking, but they havenít figured out how to maximize its value....

January 23, 2025 | 5 min read

Partner Content

Making Visitor Management a Welcome Experience

If youíre in CRE, you already know the challenges of managing and tracking visitor access at your properties....

November 22, 2024 | 3 min read

.gif)